WAGTX Commentary (Q2 2021)

June 2021

OVERVIEW

Since late 2020 a healthy bounce in value stocks has propelled indexes higher. Meanwhile, investors have generally taken profits in growth stocks in spite of strong business fundamentals, particularly the ones that thrived most from pandemic lockdown conditions. Together these two factors have created some drag for the Seven Canyons World Innovators Fund, given its focus on market-share-gaining growth companies, and the Fund underperformed its benchmark slightly during the June quarter.

WAGTX Performance vs. Benchmark

| Periods ended 6/30/21 | WAGTX | MSCI ACWI Ex-USA Small-Cap Index |

|---|---|---|

| Quarter | 4.34% | 6.35% | YTD | 1.67% | 12.24% | Year | 52.15% | 47.04% | 3 Years Annualized | 22.82% | 9.78% | 5 Years Annualized | 21.24% | 11.97% | 10 Years Annualized | 14.36% | 7.02% |

Data shows past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the data quoted. For the most recent month-end performance data, visit www.sevencanyonsadvisors.com. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Advisor may absorb certain Fund expenses, leading to higher total shareholder returns. The Advisor has contractually agreed to reimburse Total Annual Fund Operating Expenses in excess of 1.76% and 1.56% for the Investor Class Shares and the Institutional Class Shares respectively until at least January 31, 2022. This agreement is in effect through January 31, 2022, may only be terminated before then by the Board of Trustees, and is reevaluated on an annual basis.

The good news is that fads fade while business fundamentals drive share price performance over the long term. We see some early signs that the narratives which have temporarily disadvantaged our style of investing are losing traction. Early in the second quarter S&P 500 Value Index outperformance stalled out, and in the month of June growth stocks raced ahead. The S&P 500 Growth Index ended the quarter up 11.44% to the Value Index’s 4% increase, and all seven percentage points of outperformance came in June. Small-cap indexes like the Russell 2000 and our benchmark the MSCI ACWI Ex-USA Small Cap have been slower on the uptake; in these indexes, growth and value stock performance was essentially neck and neck for the quarter. Just one week into the third quarter, Russell 2000 growth stocks have outperformed value stocks by four percentage points, perhaps signalling that they are back in favor.

We think the changing of the guard is being propelled by an overshoot in value sectors. We suspect that all of the recovery expected in the Energy, Financials, and Materials sectors in 2021-22 has already been priced in. Over the next several quarters, sales and profits will grow significantly year-over-year for companies in these sectors, but the rates of growth will start decelerating rapidly beginning this September quarter due to tougher comparisons in the latter half of 2020. We think the growth rates for most value companies will soon settle back nearer to their pre-Covid single-digit levels, closer to GDP growth rates. On the other hand, the innovative growth companies we own took market share and grew double-digits pre-Covid, got a big boost and grew much faster during the height of Covid, and we expect them to press market share gains and grow double-digits once again post-Covid.

DETAILS FOR THE QUARTER

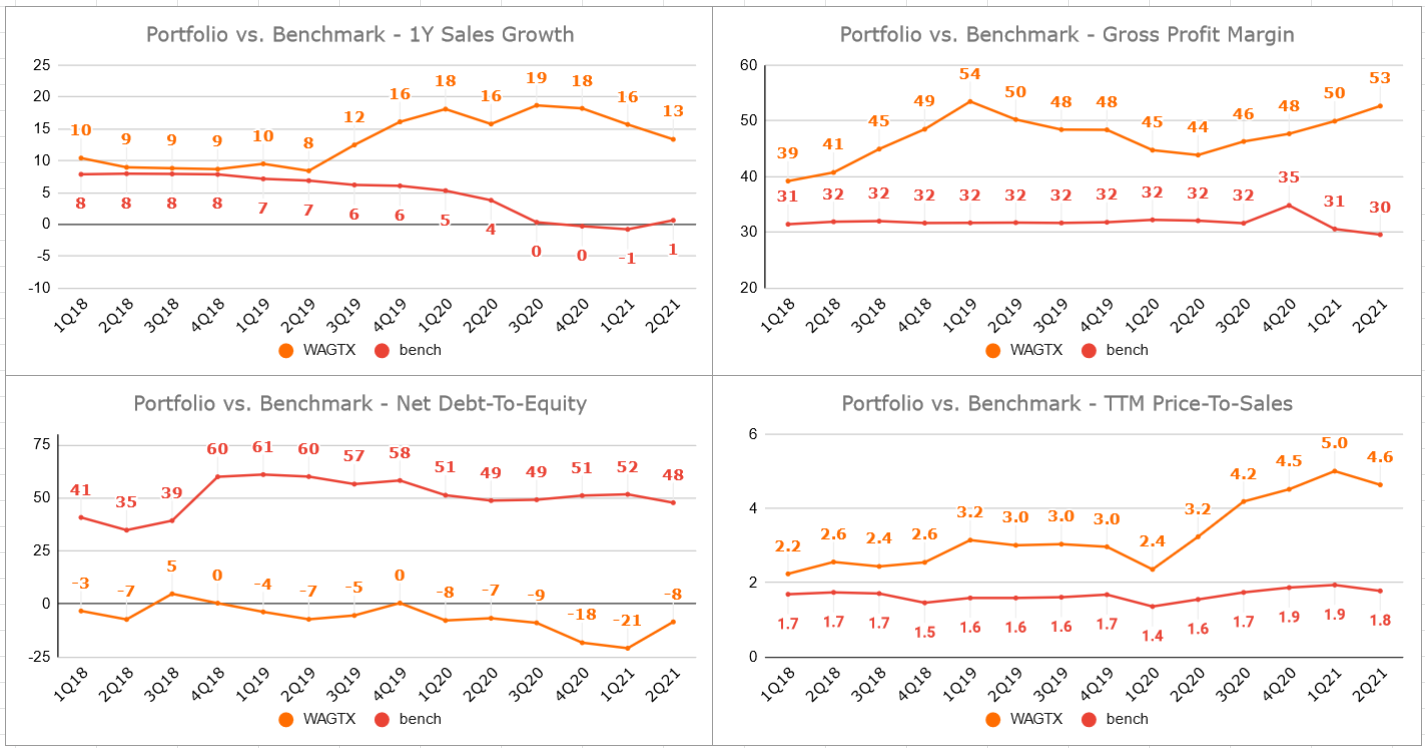

We track some simple key metrics on a portfolio basis over time to ensure we are sticking to our investment philosophy by maintaining premium growth rates, margins, and balance sheets.

Chart: WAGTX key metrics vs. the benchmark

Source: Bloomberg

At a glance, one notices that the portfolio has generally improved and widened the gap versus the benchmark on all key metrics over the three-year period displayed. The chart on the bottom right shows that we pay up for what we consider to be better companies, creating more shareholder value.

In 2021 the growth rates for our portfolio companies dipped a little bit. The shares of companies in the portfolio that benefit the most from vaccine rollouts and economies opening up have performed well this year, and thus their weight as a percentage of the portfolio has naturally gone up. In addition, we intentionally rotated more of the Fund’s assets into vaccine rollout beneficiaries, which we quantify as companies whose sales decelerated more than 10% due to Covid, and for which we expect a rebound with growth rates of at least 20% over the next year. At the end of June, 41% of the Fund was invested in vaccine rollout beneficiaries, up from 17% at the end of 2020. The effect of more vaccine beneficiaries in the Fund at larger weights, was to drag the sales growth for the portfolio down temporarily; remember these are companies that saw parts of their business completely shut down due to Covid. We are not concerned with the slight dip in portfolio growth rates. The June results season has already started, and companies that were hurt by Covid are reporting significant sales growth acceleration. In fact, we would be shocked if the portfolio’s 1-year sales growth rate doesn’t improve by several percentage points by the end of the September quarter.

Our top two contributors during the quarter were Fevertree (FEVR LN) and Volaris (VLRS), both vaccine rollout beneficiaries which contributed more than 100 basis points of positive performance during the quarter, with shares up 21% and 34%, respectively.

UK-based Fevertree makes high-end cocktail mixers, e.g. expensive and delicious craft tonic water. In normal times, Fevertree makes nearly half its revenue from bars, restaurants, and hotels, so when Covid hit, all of that business disappeared. Almost immediately however, high-end mixers started flying off the shelves of grocery stores. Fevertree took significant market share from old staple brands like Schweppes, and the company’s sales ended the year down only 3%. With the hospitality sector opening back up fast in its top two markets, the UK and the US, we think Fevertree’s sales will grow around 20% during the second half of 2021 and first half of 2022.

Volaris is a discount airline serving Mexico and the US. The pandemic almost completely shut down the global airline industry in April 2020, and the company’s sales growth went from up 27% in 2019, to down 81% in the June 2020 quarter. Volaris recovered exceptionally quickly. Thanks to its low-cost operator business model, and some weaker competition being forced to file bankruptcy, the company gained double-digit market share during the last year. By December 2020, passenger volumes had completely recovered and were up on a year-over-year basis. We expect the company to grow revenue by at least 50% in 2021.

We had no large detractors with greater than 50 basis points of negative contribution. Looking at the basket of stocks that did subtract from performance, there’s a clear theme of other investors taking profits in names that performed exceedingly well in 2020. Included in this basket are names such as AO World (AO/ LN), Thunderbird Entertainment (TBRD CN), Whispir (WSP AU), va-Q-tec (VQT GY), and V-Cube (3681 JP). These businesses are all seeing the strongest demand they’ve ever witnessed for their products, but were caught up in the value rotation narrative. We continue to hold shares in each one, and expect them to contribute positively to future performance.

OUTLOOK

We do not do macroeconomic research. We do listen to macroeconomic theories, and when our observations from bottom-up research provide evidence supporting a theory, we pay attention. Currently, we believe the most important macroeconomic driver of stock performance is the effect of Japanification spreading to most big economies around the globe. Japanification is the theory that government bailouts and profligate spending lead to lower interest rates and high debt levels, which, when combined with aging demographics, leads to low economic growth rates. This cycle started in Japan after its asset bubble in the late ’80s, and the economy has been stuck in first gear ever since. We have invested in Japanese equities for 15 years now and have observed that the impact of interminable slow GDP growth on the Japanese stock market has been a very long cycle of growth stock outperformance. Because growth stocks are scarce in Japan, their prices get bid up. We think the same pattern has developed to some degree in major stock markets around the world. If this is the case, as growth investors, our portfolio of companies will benefit. Now, we understand that market chatter is all about inflation heating up and interest rates going much higher. We are not experts, but we tend to think that inflation will be transitory; demographics are the same and debt levels are much higher, so we would expect rates to remain relatively low.

We are experts in finding and investing in small-cap growth that we think can one day mature into mid- and large-cap quality growth stocks with high valuation multiples. Given the aforementioned economic conditions, we focus on uncovering the best quality growth companies—leaders in their industries and still taking market share—and try not to be overly sensitive about their valuations. This investment style has generated a superb track record for the last 10+ years, and we believe it may continue to lead to satisfactory returns for our shareholders, regardless of the macroeconomic environment.

Thank you for the opportunity to manage your investments.

Definitions

Basis Points are a one hundredth of one percent

MSCI ACWI Ex-USA Small Cap Index captures small-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 27 Emerging Markets (EM) countries. With 4,413 constituents, the index covers approximately 14% of the global equity opportunity set outside the US.

Net Debt-To-Equity: The ratio used to evaluate a company's financial leverage calculated by dividing a company’s total liabilities by its shareholder equity.

TTM Price-To-Sales: The ratio shows how much investors are willing to pay per dollar of sales for the trailing twelve months (TTM).

For a list of current top ten holding and performance charts, please click here.

All investing involves risk. Investments in securities of foreign companies involve additional risks, including less liquidity, currency-rate fluctuations, political and economic instability, and differences in financial reporting standards and securities market regulation. Investing in small and micro-cap funds will be more volatile, and loss of principal could be greater than investing in large cap or more diversified funds. There is no guarantee that the Fund will meet its investment objective.

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. To obtain a Prospectus, which contains this and other information, visit www.sevencanyonsadvisors.com or call us at +1 (833) 722-6966. Read the prospectus carefully before investing.

Seven Canyons Funds are distributed by ALPS Distributors, Inc.