WAGTX Commentary (Q4 2021)

DECEMBER 2021

PREFACE

As many reading this letter already know, the holiday season was a sad time for my family and the Seven Canyons Advisors team, due to the passing of our father and business partner Sam Stewart. It’s rare that a soft spoken, introverted, card carrying “nerd” (his words not mine) becomes a mentor to so many, and a businessman of such great importance in his home state. What made him great was not a long list of accomplishments, but rather his dedication to a short list of people and activities he truly cared about. He loved his family, his studies, his sports heroes and favorite teams, his work and his coworkers. He loved spending time at the ranch where he grew up in Central Utah, especially during spring runoff when he’d put on mud boots, grab a shovel, drag as many kids and grandkids as he could along, and play in the ditches under the guise of doing irrigation work. Last but not least, he wholeheartedly loved the stock market. He took it as a personal challenge every day to work harder and smarter and to know his companies better — he lived to beat the stock market! His joyful pursuit of this task was infectious, and inspired hundreds of students and younger colleagues who witnessed it to make a career out of their passion, inside or outside of finance.

On a personal level, I have written the quarterly shareholder letter for this fund with the help of my father for over a decade. My best memories of working together, by far, are from this small part of the job. Our writing style synced up almost perfectly, preferring succinct, plainspoken English over cryptic finance jargon that intends to impress more than communicate. My father was known as an unusually smart man, but not many people knew about his more subtle talents as a writer and editor. I knew these talents intimately. His skills as an editor impressed me every quarter. He expertly transformed my rough drafts into clear professional messages that maintained our off-Wall-Street/in-Utah style, and the turnaround seemed to take mere minutes. Right now I’m really missing him, for his skill as an editor, but I’m talking even more about the feeling of being perfectly in sync with my dad, working shoulder to shoulder to produce a letter for our shareholders that we could be proud of.

OVERVIEW

After an incredible year investing in 2020 when every decision seemed to go our way, 2021 had its frustrating moments. The financial papers were filled with stories of inflation, labor shortages, and supply chain disruptions, and of course COVID COVID COVID, the root of all these unprecedented pressures. Our companies did what everyone did and adapted to the changing conditions. They increased wages, offered signing bonuses, and raised prices. They ordered additional inventory early, expanded supplier networks, and moved manufacturing closer to end customers. They struck long term deals to secure reasonable ocean freight rates, and when that didn’t work, shipped critical components by air freight, and when that didn’t work, reengineered systems to use the components that were available. The hustle paid off and their businesses survived and even thrived; our average company reported high-teens sales growth with limited margin compression. In spite of this admirable fundamental performance, investor sentiment created significant headwinds for our style of investing and most of our investments suffered valuation multiple contraction. We covered some of the main sentiment headwinds in prior letters this year, including: rotation from growth to value stocks; commodity sectors outperforming secular growth sectors; earnings guidance downgrades caused by supply chain issues; and large market caps favored over mid- and small-caps, with micro-caps getting tossed out “baby with the bathwater” style.

The December quarter delivered one final and impactful blow that hurt investor sentiment toward our style of investment — the news of interest rate hikes coming in 2022. It is currently the belief among many investors that growth stocks are bigger beneficiaries of falling interest rates than value stocks because they are “longer duration” assets, meaning one owns them for cash flows that will be generated far into the future. Using a Discounted Cash Flow model, the industry standard for valuation of future cash flows, a company’s paper value goes down when interest rates go up. A pattern has formed in recent years that for a period after the news of rate increases hits, like it did in December, the prices of innovative growth companies take a hit. The long term data, however, doesn’t support the belief that growth stocks fare any worse than value stocks in rising interest rate environments. And we believe that in the long term it is company earnings that drive stock prices. That is why we think of the recent sell-off in growth stocks as something like a Taper Tantrum 2.0, and treat it as a buying opportunity in our highest quality holdings.

Nonetheless, our style of investing in innovative growth companies was the primary factor behind the recent underperformance shown in Chart 1.

Chart 1: WAGTX performance vs. its benchmark

| Periods ended 12/31/21 | WAGTX | MSCI ACWI Ex-USA Small-Cap Index |

|---|---|---|

| Quarter | -7.68% | 0.62% | Year | -12.72% | 12.93% | 3 Years Annualized | 20.85% | 16.46% | 5 Years Annualized | 16.04% | 11.21% | 10 Years Annualized | 13.26% | 9.46% |

Data shows past performance. Past performance is not indicative of future performance and current performance may be lower or higher than the data quoted. For the most recent month-end performance data, visit www.sevencanyonsadvisors.com. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Advisor may absorb certain Fund expenses, leading to higher total shareholder returns. The Advisor has contractually agreed to reimburse Total Annual Fund Operating Expenses in excess of 1.76% and 1.56% for the Investor Class Shares and the Institutional Class Shares respectively until at least January 31, 2022. This agreement is in effect through January 31, 2022, may only be terminated before then by the Board of Trustees, and is reevaluated on an annual basis.

DETAILS FOR THE QUARTER

In times like these, when the business environment is difficult and investor sentiment is not going our way, we think the best thing to do is hunker down and re-evaluate the companies we own. This year we made a goal to speak to each of our management teams at least once a quarter and to increase our efforts to collaborate with other large investors in our portfolio companies. As a result, we spent more hours of the day researching the companies we own and fewer looking for new investment ideas. A more quantifiable result was a significant reduction in the number of companies owned in the portfolio, from 70 at the beginning of the year to 52 today, and a dramatic reduction in name turnover going forward.

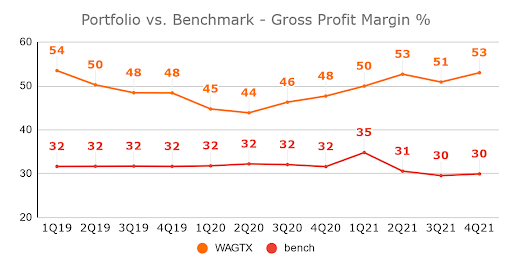

We track some simple key metrics for the portfolio on a quarterly basis to ensure that the fundamental characteristics of our portfolio align with our investment strategy of buying quality growth companies that are rapidly taking market share. These metrics include: consistent double-digit sales growth, the most important metric in the search for small-caps that can graduate to mid- and large-caps one day; high gross profit margins indicating leading products and services that are so desired or vital that our companies’ customers willingly pay premiums to obtain them; and low leverage, because we think a good balance sheet is the best risk reduction tool. In addition, we watch the price-to-sales multiple to get a sense for what price we pay for our investments. We think that chart 2 helps visualize the qualities of the portfolio's investments. Our companies grow much faster with much higher margins and more conservative balance sheets than the average benchmark company. The valuation chart, on the bottom right, illustrates how multiples for our style of investment re-rated in 2020 only to de-rate in 2021. We cannot say exactly when this de-rating cycle will end. However, we believe that our companies’ fundamentals are strong and should eventually support higher stock prices.

Chart 2: WAGTX portfolio key metrics

Source: Bloomberg

Consistent double-digit sales growth is the most important metric in the search for small-caps that can graduate to mid- and large-caps one day. This metric accelerated nicely due to the world’s economies opening up thanks to the COVID vaccine rollout. We track gross profit margins because we think high gross margins signal leading products for which customers are willing to pay high prices. We track balance sheet leverage (debt-to-equity) because we think a good balance sheet is the easiest way to mitigate unexpected risks. It also implies that a company’s growth is likely organic and not fueled by debt-funded acquisitions.

The biggest positive contribution to the Fund’s performance during the quarter came from Fevertree Drinks (FEVR LN), which was our largest holding and had an increase in its share price of 16.58%. Fevertree is the quintessential example of a World Innovators company. It was founded in 2004 by Charles Rolls, who was an executive in the spirits industry, and Tim Warrillow, an ad executive. Their backgrounds placed them perfectly to pick up on the rapid growth in the premium craft spirits market (way back in 2003), and, critically, to note that there were no premium mixers to go with the new top shelf gins. Being British, they decided to fill that void, starting with premium tonic water for the perfect gin & tonic. Today they have built the leading premium mixer brand in the world. Their niche of the beverage market has consistently grown 20%+ per annum and despite being the uncontested leader, they are taking share and growing at an even faster clip (ex-2020 COVID lockdowns). Given the US is the largest beverage market in the world with 40% penetration of premium spirits and only 7% penetration of premium mixers, we think the company can easily double or triple in size in the next 10 years.

The biggest detractors for the period were from a basket of innovative online retailers and cloud-based software companies that benefited from COVID lockdowns in 2020 only to have the long term strength of their businesses questioned in 2021. AO World (AO/ LN) and Oisix ra Daichi (3182 JP) hurt performance the most with share prices down 48.98% and 39.71% respectively. AO World is the dominant online appliance retailer in the UK and we think it has a very bright future ahead of it as it expands into continental Europe. That said, supply chain disruptions led to slower sales and lower margins in 2021. We decided to step aside momentarily and sold the remainder of our position in AO because we think improvements to the global supply chain will likely take more time than consensus expectations. Oisix is the leading at-home meal kit supplier in Japan. As one might expect, the meal kit business boomed during COVID, but as bars and restaurants started to open back up in Japan some investors got nervous and sold the stock, hence the 2021 dip in performance. Management's perspective is that eating habits have been altered for good and that meal kits and online groceries will only grow from here. We tend to agree with management, and so far sales have remained brisk. Oisix remains a top 10 holding in the Fund.

OUTLOOK

We can honestly say we are thrilled with the portfolio’s key metrics and the quality of the companies we own. Sentiment went against our investments in 2021 and so far the headwinds continue to blow in 2022. We don’t think this will last long. We think the global economy and most companies will be stuck in a low growth mode for some time given demographic trends and high debt levels. This should mean companies that report consistent high-teens growth, like the World Innovators’ portfolio of companies, become relatively scarce, and that scarcity factor should support premium valuation multiples. Every quarter that our companies report results is an opportunity to remind investors of their fundamental qualities — unique business models, superior products and services, market share gains, and fast sales growth. We are confident that in the long run strong fundamentals and earnings growth will drive stock prices rather than fickle investor sentiment.

Finally, we wish you and your families well in 2022 and thank you for the opportunity to manage your money.

Sincerely,

Josh Stewart

Definitions

Net Debt-To-Equity: The ratio used to evaluate a company's financial leverage calculated by dividing a company’s total liabilities by its shareholder equity.

TTM Price-To-Sales: The ratio shows how much investors are willing to pay per dollar of sales for the trailing twelve months (TTM).

For a list of current top ten holding and performance charts, please click here.